A lasting commitment to our clients

American Century Life Insurance Company has a long history of serving families and helping them with their annuity and life insurance needs.

The company was founded in 1940 in Jacksonville, Texas, as Cherokee Burial Association. In 1980, the Boren family combined this burial association with other similar associations and created the Boren Life Insurance Company.

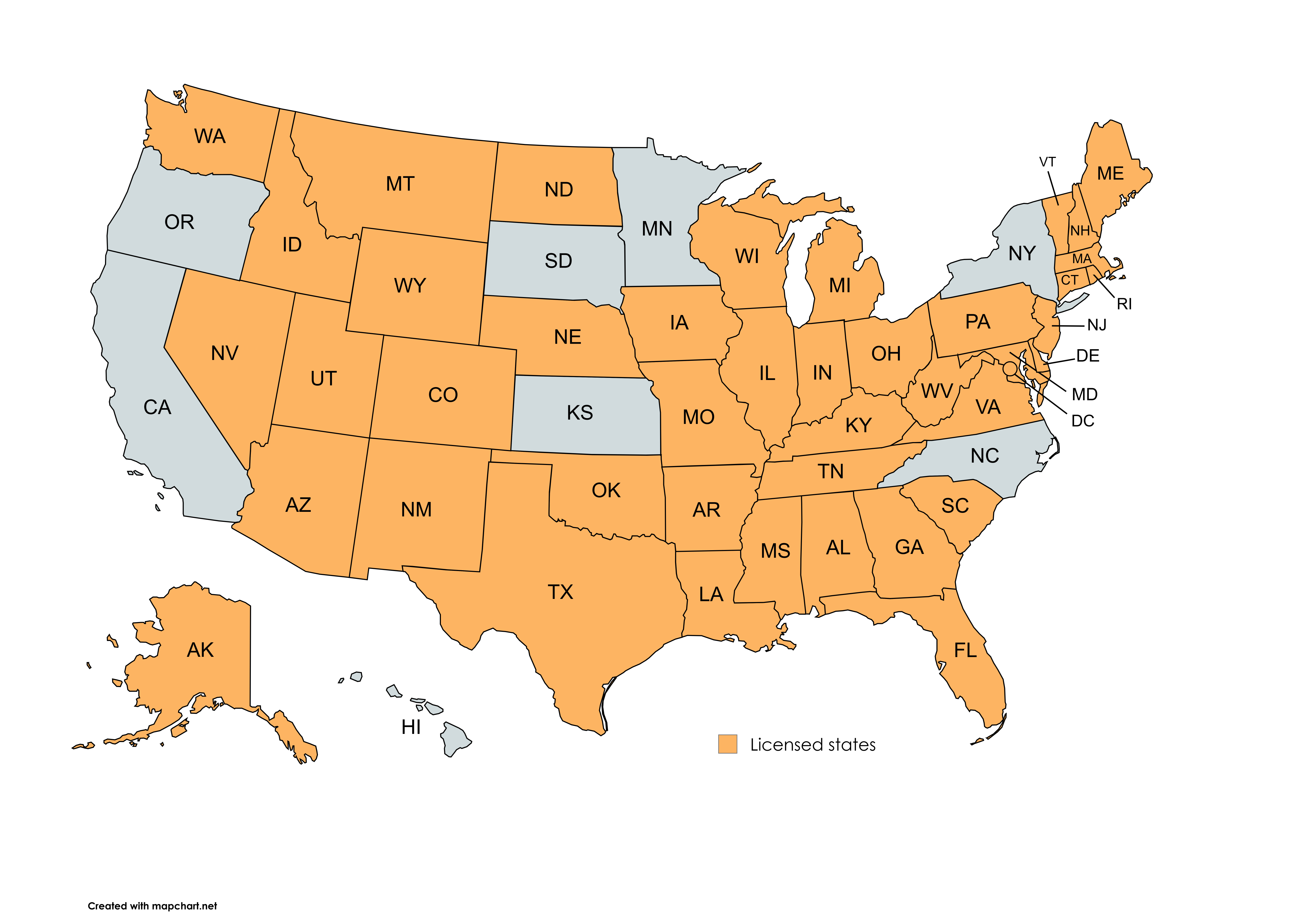

The company became American Century Life Insurance Company of Texas in 2000 and American Century Life Insurance Company in 2021 to reflect our commitment to serve a growing number of individuals and families in the 43 states in which we’re currently licensed to do business (the company operates in Oklahoma under the name American Century Life Insurance Company of Texas.) We are domiciled in Columbus, Ohio, with administrative offices in Allen, Texas.

A pillar of financial strength

American Century Life Insurance Company has been assigned a Financial Strength Rating of B++ (Good) from AM Best.

It also received a Long-Term Issuer Credit Rating of “bbb+” (Good) with an outlook assigned to these Credit Ratings (ratings) of stable as of August 2024.

The ratings reflect American Century’s balance sheet strength, which AM Best assesses as strong, as well as its adequate operating performance, limited business profile and appropriate enterprise risk management (ERM).

American Century’s strong level of balance sheet strength is underpinned by its risk-adjusted capitalization being assessed at the strongest level, as measured by Best’s Capital Adequacy Ratio (BCAR). AM Best expects American Century’s risk-adjusted capitalization to remain at the strongest level prospectively.

American Century Life Insurance Company has earned a Financial Stability Rating® (FSR) of A, Exceptional, from Demotech, Inc.

Demotech is a Nationally Recognized Statistical Rating Organization (“NRSRO”) specializing in evaluating the financial stability of independent, regional and specialty insurers. Since 1985, Demotech has served the insurance industry by assigning accurate, reliable and proven Financial Stability Ratings® (FSRs) for Life & Health insurers, Property & Casualty insurers, and Title underwriters.

FSRs are a leading indicator of financial stability, providing an objective baseline of the future solvency of an insurer. They are accepted by several government-sponsored enterprises, including Fannie Mae, Freddie Mac, various programs of the United States Department of Housing and Urban Development (HUD), and mortgage lenders as well as premium finance companies.

Demotech is the only company, in addition to AM Best, that is acceptable to insurance carriers of agent E&O policies, and the insolvency exclusion in many policies include companies with certain Demotech ratings.